Consider a Planned Gift

Please note, this video is not compatible with IE 10. Please use an alternate browser.

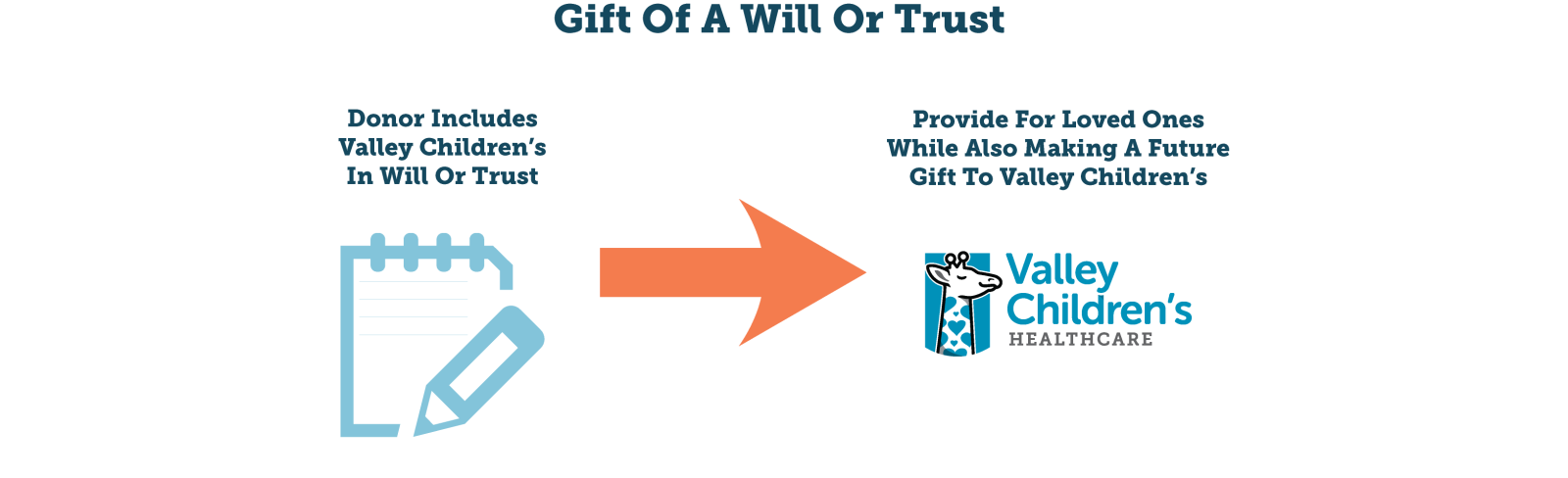

There are many ways to support Valley Children's Healthcare with a gift through your will or trust. For most of us, a planned gift is our only opportunity to make a significant difference for a cause we care about. Below are several vehicles for charitable giving through your estate plan.

Charitable Bequest

A charitable bequest included in your will or trust is one of the easiest ways you can leave a gift to Valley Children’s. With the help of your attorney, you can include language in your will or trust specifying a gift to be made to Valley Children’s as part of your estate plan. A bequest can be made in at least three ways:

- Percentage bequest - make a gift of a percentage of your estate

- Specific bequest - make a gift of a specific dollar amount or a specific asset

- Residual bequest - make a gift from the balance or residue of your estate

Beneficiary Designation Gifts

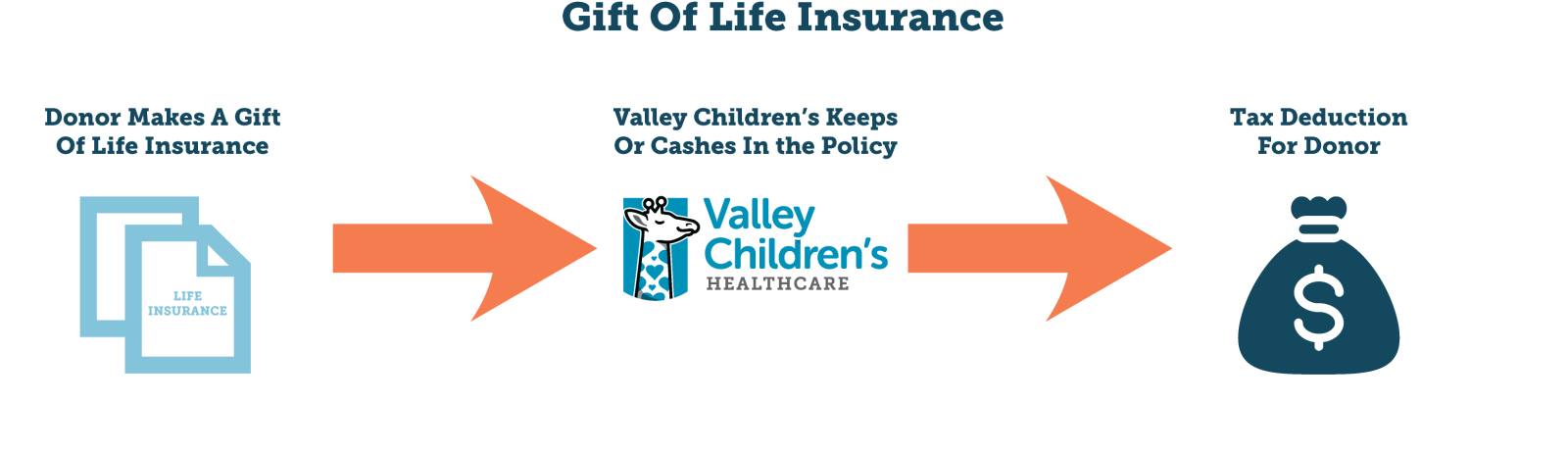

A beneficiary designation gift occurs when you designate Valley Children’s as a beneficiary of a retirement, investment or bank account, or your life insurance policy. To make your gift, contact the person who helps you with your account or insurance policy, such as your broker, banker or insurance agent. Ask them to send you a new beneficiary designation form. Complete the form, sign it and mail it back to your broker, banker or agent. When you pass away, your account or insurance policy will be paid or transferred to Valley Children’s, consistent with the beneficiary designation.

Charitable Gift Annuity

A charitable gift annuity is a gift made to Valley Children's that can provide you with a secure source of fixed payments for life. When you establish a charitable gift annuity, you transfer cash or property to Valley Children's. In exchange, we promise to pay fixed payments to you for life. The payment amount depends on the size of the annuity’s principal and your age at the time the gift is made. Depending on how you fund the annuity, a portion of each payment may even be tax-free. You will receive a charitable income tax deduction for the gift portion of the annuity.

Example: Sally is 70 years old and wants to establish a charitable gift annuity with $100,000. Based on her age, her gift annuity rate is 5.1% annually, so Sally will receive $5,100 per year in income. The gift annuity is designed so that Sally will benefit from the interest and exactly half of the principal in the event that she lives exactly to her life expectancy.

Life Estate

A gift of a remainder interest in a personal residence is described generally as a transaction in which an individual irrevocably transfers title to a personal residence to Valley Children’s with a retained right to the use of the property for the rest of the owner's lifetime, or for the lifetime of the owner and his or her spouse, as specified in a gift agreement. At the conclusion of the measuring term, all rights in the property are transferred to Valley Children’s as a “remainderman.”

With a Life Estate form of ownership of real estate there are two separate categories of owners of the property: (1) the life tenant owner, who has absolute and exclusive right to use of the property during their lifetime, which expires automatically upon the death of the last to die of the life tenant(s); and (2) the remainder owner (Valley Children’s), which becomes the owner of the real estate upon the passing of the life tenant owner(s).

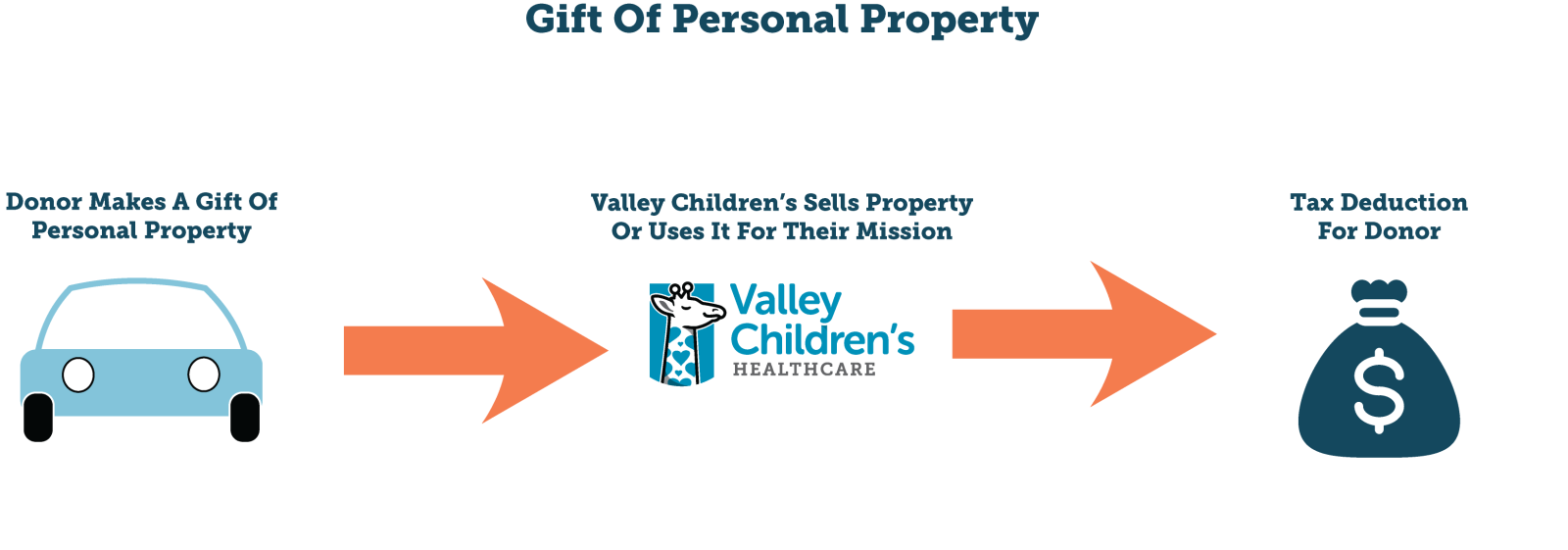

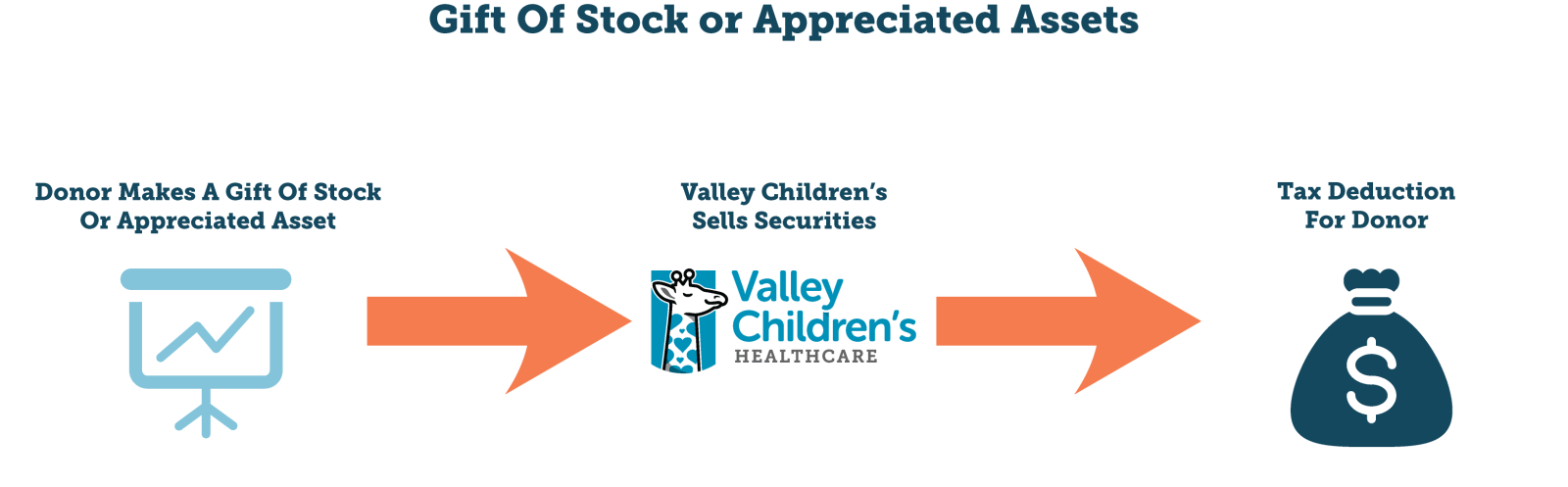

Additional Examples of Planned Gifts

Legacies of Healing Society

Ensuring the health of our children. There's no greater gift you can give.

Join the Legacies of Healing Society

Valley Children's Healthcare Foundation has created an exclusive membership program to recognize a very special group of donors. It is called the Legacies of Healing Society, and it is reserved for those who have made a provision in their estate plan for a gift to Valley Children's.

The Society is open to anyone wishing to partner with Valley Children's through his or her estate. It provides us an opportunity to recognize a donor's commitment to a hospital that's given so much to our community.

Leave Your Legacy

A bequest often offers the opportunity to make a more substantial gift than would be possible during one’s lifetime. If you have assets that have appreciated significantly, it may not be possible or advisable to use these assets to make an outright contribution. These assets can be designated instead to a planned gift to maximize tax and other financial benefits.

By becoming a member of the Legacies of Healing Society, you’ll join a very special group of people who are committed to creating a legacy for the children of our community.

Membership Benefits

As a Legacies of Healing Society member, your charitable gift will be used to help Valley Children’s continue to provide the highest levels of health care to the children of Central California. Funds can be designated to support any area of the Hospital you choose, or wherever the need is greatest.

Society members will also receive:

• Special recognition at the annual Legacies of Healing Society celebration

• Regular hospital updates through our E-Newsletter

• VIP invitations to receptions and other social events sponsored by Valley Children’s Hospital

Ways to Join

There are a number of ways to leave a charitable gift to Valley Children’s, including:

• Bequest in a will or family trust

• Create a charitable trust

• Beneficiary of a life insurance policy

• Beneficiary of an IRA or retirement plan

• Gift of remainder interest in a real property such as a house or farm

• Charitable gift annuity

For more information on naming Valley Children’s Healthcare in your estate plan, please speak to your financial advisor or contact the Foundation at (559) 353-7100.